Our portfolio

We provide investors with access to entrepreneurs who build enduring businesses, specialising in technology and healthcare. As we focus on the B2B sector, our companies may not be household names but some have gone on to make a real impact in their industries, being acquired by global brands or listed on global exchanges:

5Mins

Gamified learning platform reinventing employee upskilling

Potrtfolio news

Investment details

Abcodia

Abcodia is a company engaged in the validation and discover of molecular biomarkers linked to age related diseases.

Potrtfolio news

Investment details

Academia

Academia is an academic research sharepoint with over 4m academic members.

Accelex

Powered by cutting-edge data science, artificial intelligence and machine learning techniques, Accelex streamlines the extraction, analysis and reporting of critical private investment data.

Investment details

Achilles Therapeutics

Achilles Therapeutics is designing therapies to target truncal tumour neo-antigens – unique flags to the immune system present on the surface of every cancer cell, which were first discovered by Cancer Research UK and the NIHR University College London Hospitals (UCLH) Biomedical Research Centre (BRC) funded scientists at the Francis Crick Institute and UCL Cancer Institute.

Truncal tumour neo-antigens are present on all cancer cells in an individual patient’s tumour but not on healthy cells, so could allow scientists to target and destroy tumours without harming healthy tissues.

Syncona and Cancer Research Technologies, with the support of UCLB and the Crick, formed Achilles Therapeutics with a round of £13.2 million ($17.5 million) led by Syncona with the CRT Pioneer Fund and UCLTF.

Investment details

Active Hotels

In September 2004 funds managed by Albion realised their holding in Active Hotels for a consideration of £10.4 million receivable in cash representing a 10x return.

Investment details

Active Lives Care

Active Lives Care owns and operates Cumnor Hill House, a 75 bed residential care home for the elderly in Cumnor Hill in Oxford.

Berkley Care Group, an award winning provider of elderly care services, operates the facility.

Albion exited its investment in Berkely Care Group in March 2021.

Investment details

Alto Prodotto Wind

Alto Prodotto Wind is a partnership with Infinite Renewables, a Welsh based consultancy with whom Albion has developed several Wind Turbines on brownfield sites in Wales. These wind turbines are all operational.

Investment details

Antenova

Antenova is a leading developer and supplier of high performance antennas and RF antenna modules for wireless communication and consumer electronic devices.

Anthropics

Anthropics Technology Ltd is a software research and development company with a world-class record of innovation in graphics and animation software.

Based in London, England, the company started its commercial operations by developing uniquely powerful animation software for leading companies in the mobile telecoms industry including Nokia, Vodafone and others.

More recently, the company has created Portrait Professional - the world's first intelligent portrait retouching software. Based on extensive in-house research, Portrait Professional has been trained with hundreds of photos of people, so it actually knows about human appearance and beauty. Consequently, Portrait Professional is massively faster and easier to use than general purpose touch-up software.

Applecroft Care Homes

Funds managed by Albion invested £4.2 million to acquire Applecroft, a 75 bed residential care home for the elderly, in July 2003. Applecroft is located in Dover, Kent. The investment was sold in April 2006 at a significant profit.

Investment details

Arecor

Arecor is a biopharmaceutical formulation company, that is developing ground breaking biological drugs that will transform the treatment of diabetes. Through its technology platform Arecor is creating faster working, more effective drugs that advance progress towards the creation of an artificial pancreas.

Investment details

Aridhia Informatics

Aridhia has built a sector-leading, differentiated informatics platform with cutting-edge analytical tools to support health care and research. It has established an international client base and a network of major strategic partners. Aridhia’s informatics platform integrates very large and complex datasets so as to make meaningful and flexible analysis possible while addressing the unique complexities of healthcare. The platform uses big data analytics to understand the relationship between healthcare events and serves two main customer needs: the effective management of chronic diseases today; and the shift to stratified medicine in the future, where a patient’s molecular profile is used to tailor preventative measures or treatments based on the likelihood of response to treatment.

Potrtfolio news

Investment details

Atego

Atego, a developer of model-based systems and software engineering applications was acquired by PTC (Nasdaq:PTC) in 2014.

Investment details

Automotive Technik

Funds managed by Albion invested a total of £3.1 million in the company in a two year period from July 2002. The investment was used to acquire the technology and set up the production of Pinzgauer all-terrain vehicles in the UK. Following the award of several important military contracts, the company was sold in April 2005 to Stewart & Stevenson and is now part of BAE Systems.

Investment details

AVORA

AVORA uses the power of machine learning and augmented intelligence to enable a new way of working with data. Its algorithms unveil insights and intelligence to businesses in seconds, versus the days if not months it would normally take.

Investment details

Bango

Investment details

Barleycroft Care Home

Barleycroft Care Home developed a purpose built elderly care home for 80 residents in Romford, Greater London. The investment was exited in April 2006.

Investment details

Black Swan Data

Black Swan has developed a predictive analytics platform which uses internal and external data to provide consumer insight to the world's leading brands

Investment details

Blackbay

Blackbay specialises in the development and implementation of real-time mobile enterprise solutions and services for supply chain and field service operations. Albion exited Blackbay in April 2017

Investment details

Bloomsbury AI

BloomsburyAI is automating expertise by building systems able to capture knowledge from unstructured and structured data and allow interrogative access in natural language. Built on the research of founder Guillaume Bouchard and UCL’s Sebastian Riedel the company has a world leading machine reading capability.

The UCL Technology Fund invested in Bloomsbury AI’s seed round together with IQ Capital, Fly Ventures and SeedCamp amonst others.

Potrtfolio news

Investment details

Bold Pub Company Limited

The Bold Pub Company and its portfolio of 30 freehold properties was sold to leisure operator Calco Midlands in 2007.

Investment details

Bravo Inns

Bravo Inns owns and operate 40 public houses based in the North of England. The focus is on acquiring tired community pubs which are then extensively refurbished.

Investment details

Broadoaks VCT Limited

Broadoaks VCT built and operated a 30 bedroom purpose-built home for residents with learning disabilities in March, Cambridgeshire. The company was successfully sold in March 2004.

Investment details

Brytlyt

Brytlyt’s vision is to empower the transformation of data into meaningful insight at the speed of thought. As market leader, Brytlyt is on a mission to innovate next-generation data solutions that are powerful, brilliant to use and easy to access for people to solve tough analytics problems.

Careforce Staffing

Employing a buy and build strategy, Careforce rapidly became a leading national provider of home care services. The company floated on AIM, which allowed the Albion funds to realise a significant part of their investment while continuing as a major shareholder. In 2007 the company was acquired by Mears Group Plc.

Investment details

Cassium Technologies

Cassium Technologies was a provider of IT services predominantly to telco operators. The company grew organically and by acquisitions and was acquired by Netstore Plc in 2005.

Investment details

Celldex Therapeutics

Celldex is an innovative biotechnology company focused on the discovery, development and commercialization of targeted immunotherapies. The technology combines vaccines with monoclonal antibodies and immune modulators as precision targeted immunotherapy for the treatment of cancer and infectious and inflammatory diseases.

Investment details

Celoxica

Celoxica delivers ultra-low latency market data access and order execution solutions to high frequency financial traders.

Chonais River Hydro

Green Highland has been developing run-of-river hydro schemes since 2007.

Investment details

Churchcroft VCT Limited

Churchcroft VCT built and operated a 34 bedroom purpose-built home for residents with learning disabilities in Witham, Essex. The company was successfully sold in March 2004.

Investment details

CISIV

Cisiv is a leading provider of software for non-interventional studies for the pharmaceutical industry. Albion funds invested in the company in 2013.

Investment details

City Screen Cinemas

Albion initially invested £1.2 million alongside City Screen Limited, the UK's leading art-house cinema operator, to develop the Cambridge Arts Picturehouse in 1999 and subsequently invested further funds to develop the Picturehouse at FACT in Liverpool in 2002, the Greenwich Picturehouse in 2004, The Ritzy in Brixton and the Exeter Picturehouse in 2005 and Cinema City in Norwich in 2007, with additional funds invested in 2009 to enable the cinemas to become fully digital.

In total Albion invested approximately £8.6 million and received total proceeds including loan stock interest, loan stock repayments and other payments over the course of the investment of over £22 million, a return of approximately 2.6x.

Investment details

Clear Review

Clear Review is a cloud-based performance management platform that promotes frequent employee feedback and continuous employee-manager conversations.

Investment details

Cluster Seven

Cluster Seven is an enterprise software company that provides secure auditing and management of spreadsheets and user-developed applications.

Investment details

ComOps Limited

ComOps is a software company quoted on the ASX which provides effective Workforce Management Solutions to the retail, logistics and healthcare sectors amongst others.

Investment details

Compass Supply Solutions

Compass Supply Solutions offers drinks logistics services to the air, cruise and rail industries.

Investment details

Concirrus

Concirrus has developed a behavioural-based underwriting platform called Quest which delivers portfolio management and predictive analytics, changing the future of risk selection, pricing and claims throughout the value chain.

Investment details

Convertr Media

Convertr is a customer acquisition platform which tracks advertising leads all the way to sale. It improves lead quality, accelerates sales and measures exact ROI all in realtime.

Investment details

Credit Kudos

Credit Kudos is a UK fintech using open banking to provide more accurate credit scoring. Credit Kudos is securely analysing bank account data via open banking, enabling lenders to make faster and more informed credit decisions.

Investment details

CS Genetics

CS Genetics is a privately-held genomics-technology company based in San Diego, California and Cambridge, UK. We're a nimble, highly-capable team focused on delivering genuine step-change innovation in genomic tools for research and clinical applications.

Investment details

Dexela

Albion first invested in Dexela in May 2006. Dexela had developed technology to optimise the use of low-dose X-rays for 3-Dimensional imaging, focused initially on the detection of breast cancer. At the time the Company had low revenues and 6 employees.

Following investment Dexela built and trialled its proprietary X-Ray imaging system. It also developed a portfolio of software modules for imaging reconstruction and visualisation. Further investment in 2008 allowed the company to acquire a detector company, enabling the development of its own range of flat-panel CMOS-based digital detectors, optimised for use in low-dose X-Ray applications. Following launch in 2009, these detectors quickly became market leading, leading to rapid, profitable growth. The Company was sold to Perkin Elmer, a US-based global healthcare technology company, in June 2011. Albion invested £2.6 million in the Company.

Albion sold Dexela in June 2008.

Investment details

Diffblue

Automated software writing platform

Potrtfolio news

Investment details

Dolphin Nurseries

Dolphin Nurseries is building a group of private children’s day nurseries in the south-east and London. The holding was sold in 2004.

Investment details

Dragon Hydro

Dragon Hydro has developed a 375kW hydroelectric power plant in the county of Gwynedd, Wales. The plant was commissioned in October 2013 and is now operational.

Investment details

Drummond Court VCT Limited

Drummond Court VCT built and operated a 36 bedroom home for residents with learning disabilities in Bury St Edmunds, Suffolk. The company was successfully sold in March 2004.

Investment details

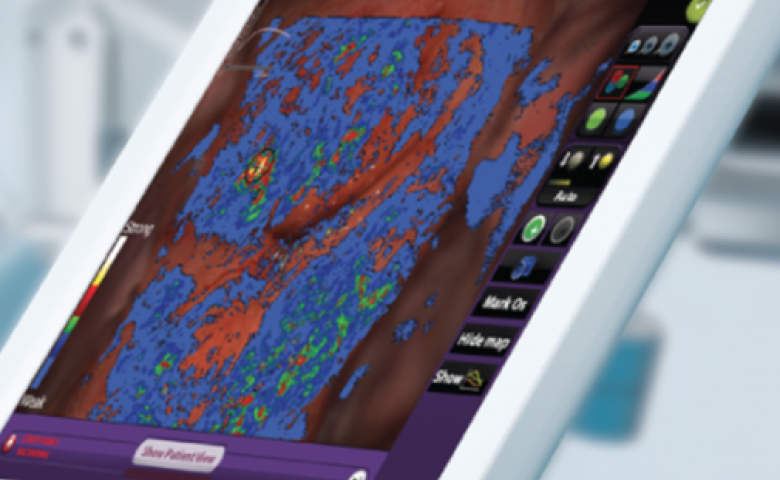

Dysis Medical

Dysis is a medical device company that designs, develops, manufactures and markets imaging systems for the non-invasive, in-vivo detection of cancerous and pre-cancerous lesions.

Potrtfolio news

Investment details

Earnside Energy Limited

Earnside Energy operates a food waste to energy anaerobic digestion and composting plant near Perth in Scotland.

Investment details

Egress Software Technologies

Egress is the leading cloud encryption platform ensuring data security for email, file transfer and collaboration environments.

Investment details

Elateral Holdings

Elateral enables clients to transform the way they manage the distribution, usage, adaptation and execution of marketing communications materials.

ELE Advanced Technologies

Non-conventional machining for industrial gas turbines for power and aerospace sectors and turbochargers for the automotive sector

Potrtfolio news

Investment details

Elliptic

Elliptic empower financial institutions and businesses to deliver safe and trusted services in cryptocurrency.

Investment details

Evolutions

Evolutions is a full service post production house providing a complete range of video, audio, grading and dvd services.

Investment details

Exco InTouch

Exco InTouch is a leading electronic Patient Reported Outcomes and patient engagement software business.

Investment details

Fastrack Resources

Fastrack Resources handles the recruitment of temporary staff in the rail sector. Albion sold Fastrack Resources in January 2003.

Investment details

Freeline Therapeutics

Freeline Therapeutics is a biopharmaceutical company based at UCL's Royal Free London Hospital and is focused on the development of liver-directed gene therapies.

Gene therapy has the potential to transform lives for people with severe diseases by providing a long-lasting, safe and reliable source of enzymes to the blood. The Company’s next-generation AAV gene therapy platform has been developed by Professor Amit Nathwani, Professor of Haematology at UCLB, and it builds on the successful haemophilia B phase I/II trial conducted by him with St. Jude Children’s Research Hospital, Memphis. The results of the study, published in the New England Journal of Medicine, demonstrated that all ten treated haemophilia B patients showed safe and sustained expression of blood clotting Factor IX after a single administration. The company will develop and commercialise gene therapies for bleeding and other debilitating disorders. Freeline’s shareholders include Syncona LLP, UCLB and UCL Technology Fund.

Investment details

Fryers Walk VCT Limited

Fryers Walk VCT built and operated a 34 bedroom home for residents with learning disabilities in Thetford, Norfolk. The company was successfully sold in March 2004.

Investment details

G.Network

Albion completed the sale of its stake in full fibre broadband operator G.Network to the Universities Superannuation Scheme Limited (USS) and Cube Infrastructure Managers (Cube), generating a 3.8x return for its venture capital trust (VCT) investors.

Potrtfolio news

Investment details

Geronimo Inns VCT

December 2009 funds managed by Albion realised their holding in Geronimo Inns VCT realising a total return of over £2m in just 18 months.

Investment details

Gharagain Hydro

Albion has built a 1MW hydropower scheme on the Allt Gharagain, close to Loch Gowan in Western Scotland.

The scheme is operational. It is generating an average 3.1GWh of electricity per year, enough to power up to 850 households.

Investment details

Grapeshot

Grapeshot is a London and New York based ad tech company providing keyword technology that matches advertising messages to relevant online content. Improving engagement between advertising and audiences, delivers more efficient and effective campaigns to both advertisers and content publishers. Grapeshot was acquired by Oracle Corporation in May 2018 for a 10x return to Albion VCTs.

Potrtfolio news

Investment details

Gravitee.io

Gravitee.io is an open source API management platform that gives businesses and their developers unprecedented control over their entire API ecosystem.

Investment details

Greenenerco

Greenenerco is a partnership with Infinite Renewables, a Welsh based consultancy with whom Albion is to develop a single 500kW Wind Turbine in Wales. The wind turbine is operational.

Investment details

Gridcog

Gridcog provides holistic software to plan, track, and optimize your transition to a decentralized and decarbonized energy future.

Investment details

Grosvenor Health

Provided occupational health services to large corporate customers.

Investment details

Haemostatix

Haemostatix is developing first-in-class topical clotting agents for the treatment of bleeding. The technology is based on a novel class of molecule that binds directly to fibrinogen to promote haemostasis. The lead candidate PeproStat, an ultra-fast topical haemostat addressing a $1bn market globally. Albion sold its stake in Haemostatix to Ergomed in May 2016.

Investment details

Hawkwell VCT Limited

Hawkwell VCT owned and operated the Hawkwell House hotel in Oxford. The hotel was extended and refurbished and the company was successfully sold in October 2002.

Investment details

Healios Limited

Healios is an online platform delivering family centric psychological care primarily to children and adolescents. The Company provides assessment, treatment and early intervention for a variety of mental health conditions.

Why we invested

The rise of mental ill health in the UK, and particularly its prevalence amongst children, has led to an increasing recognition that traditional mental health service delivery models are inadequate. By uniquely pairing technology with clinical and technical expertise, Healios is able to efficiently deliver high quality family-centric care to a severely underserved population.

Potrtfolio news

Investment details

Hilson Moran

Hilson Moran provides consultancy in building services, sustainability, facilities management and other services and is firmly established as a leading service engineer to commercial office, retail, leisure, hotel and residential projects. Completed projects include “The Gherkin”, Wembley Arena and the Olympic Village at Stratford. The company employs more than 250 staff based in London, Manchester, Farnborough, Abu Dhabi and Qatar. Albion Capital sold its stake in Hilson Moran to Tyrens generating a 3x return and 43% IRR

Investment details

House Of Dorchester

House of Dorchester, a premium chocolatier was acquired by Charbonel et Walker in 2014.

Investment details

Hussle

Hussle (previously known as PayAsUGym) is a fast growing business that enables its customers to visit a wide range of health and fitness clubs on a flexible basis, without the need to subscribe for long term memberships or undergo inductions and fitness assessments. Hussle was founded in 2010 by Jamie Ward and Neil Harmsworth. To date the company has signed up more than 2,500 health and fitness facilities.

Investment details

Imandra

Imandra is a cloud-native automated reasoning engine.

Imandra's groundbreaking AI helps ensure the algorithms we rely on are safe, explainable and fair.

Investment details

InCrowd Sports

InCrowd Sports has developed the leading mobile fan engagement platform for fans of live sports.

Investment details

Innovation Broking

Innovation Broking is an independent commercial insurance broker providing corporate insurance broking services for companies and organisations seeking board level advice.

Investment details

J&S Marine

In 2007 AVL engineered a profitable exit to a secondary MBO.

Investment details

kennek

London-based fintech that offers an operating system for lenders.

Potrtfolio news

Investment details

Kew Green VCT (Stansted) Limited

Kew Green VCT (Stansted) Limited owns the long leasehold interest in and operates the 254 bedroom Holiday Inn Express hotel at London Stansted airport.

Investment details

Kohort

Forecasting analytics startup transforming how global finance teams plan for the future

Investment details

Koru Kids Limited

Koru Kids is an online market place for nannies. The business launched in July 2017 with an initial focus on matching parents with after-school nannies in London.

Potrtfolio news

Investment details

Lab M Holdings

Lab M has long enjoyed an international reputation for the high quality and range of its dehydrated culture media, routinely used in microbiology laboratories around the world. It was acquired by Neogen Corporation in 2015.

Investment details

Leisure Links International

Investment details

Locum's Nest Limited

Locum's Nest is a web platform and mobile application which allows NHS Trusts to manage their requirements for Locum doctors in a more efficient and cost effective way.

Potrtfolio news

Investment details

Lombardy Court VCT Limited

Lombardy Court VCT built and operated a 24 bedroom home for residents with learning disabilities in Ipswich, Suffolk. The company was successfully sold in March 2004.

Investment details

Masters Speciality Pharma

Established in 1984, Masters is principally engaged in the compliant sourcing of a broad range of established branded prescription drugs (or their generic equivalent) and pharmacy medicines. Albion funds successfully exited their investment in Masters in March 2017

Investment details

MeiraGTx

MeiraGTx is a vertically integrated, clinical stage gene therapy company with four ongoing clinical programs and a broad pipeline of preclinical and research programs. MeiraGTx has core capabilities in viral vector design and optimization and gene therapy manufacturing, as well as a potentially transformative gene regulation technology. Led by an experienced management team, MeiraGTx has taken a portfolio approach by licensing, acquiring and developing technologies that give depth across both product candidates and indications.

Investment details

Memsstar

Memsstar (formerly called Point 35 Microstructures Ltd) is a technology leader in MEMS (Micro Electro-Mechanical Systems) processing, with their proprietary memsstar® range of specialist etch and deposition equipment and unique process integration knowledge.

Potrtfolio news

Investment details

Mi-Pay

Mi-Pay specialises in delivering fully outsourced on-line payment solutions to digital ecommerce clients, primarily in the mobile sector. The primary focus is processing pre-paid top ups online on behalf of customers in Europe, the Middle East and Asia.

Investment details

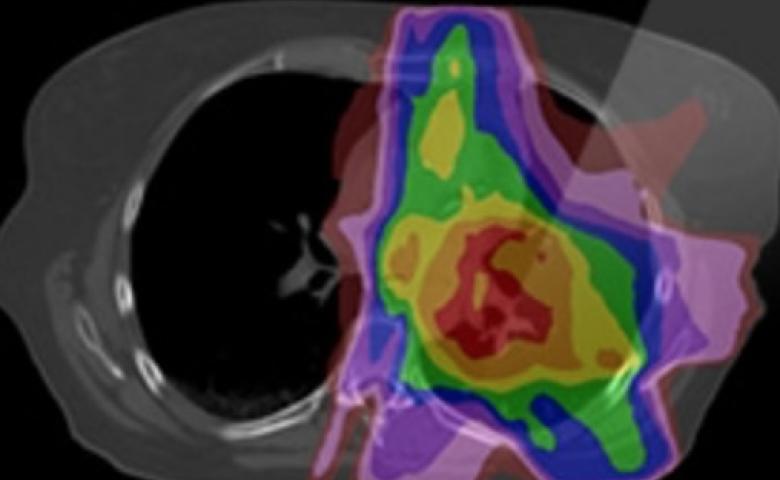

Mirada Medical

Mirada Medical, a spin out from Siemens, has developed software that allows images from multiple sources to be combined to provide greater clinical certainty in diagnosis and treatment of cancer.

Potrtfolio news

Investment details

Mount House School

Mount House School is a senior independent co-educational day school in Hadley Wood, near Barnet in North London, located in a Grade II* Listed former convent which was first adapted and established as a school in 1903. With Albion investment the management team are investing in both new facilities and modernisation of the existing site to enhance the student experience. The school is run by an experienced team of professionals who treat every student as an individual and support pupils to strive for academic excellence within a clear framework of personalised pastoral care and well-being.

Investment details

MPP Global

MPP Global offers a cloud billing platform for enterprise subscription businesses in the media, sport and retail sectors.

Investment details

My Meds & Me

My Meds & Me provides a web-based solution for the capture of adverse event, product complaint and targeted medical information for pharmaceutical companies.

Investment details

Nelson House

Albion has sold UK based mental health hospital Nelson House to Sussex Partnership NHS Foundation Trust and Care UK for £8 million.

Investment details

Neurofenix

Digital rehabilitation platform

Investment details

NuvoAir

NuvoAir's digital respiratory care platform empowers patients to better manage their health. The technology and care services fit seamlessly into a patient's routine and allows the patient and doctor to make care decisions based on real-time data and insights.

Investment details

Oakland Care Centre

The company owned and operated Bayfield Court, a 46 bed care home for the elderly located in Chingford, Essex. The home won a number of care industry awards during the period of Albion’s investment and was sold successfully in December 2014 to one of the largest industry consolidators.

Investment details

Odyssey Glory Mill Limited

Odyssey Glory Mill developed and operated the Odyssey Glory Mill health and fitness club near Beaconsfield. The company was successfully sold in December 2004.

Investment details

OmPrompt

OmPrompt offers customer automation management solutions that streamline order-to-cash processes for global manufacturing companies.

OmPrompt launched its award-winning cloud-based service in 2005. OmPrompt now leads the market for customer automation management in the consumer goods, medical device and logistics sectors. Customers include Groupe Danone, Kellogg's, Kimberly-Clark, Corporation, Unilever, Medtronic inc., Smiths Medical, Stryker Corporation, DSV and CEVA.

Investment details

Ophelos

A debt resolution agency on a mission to change narrative around consumer debt

Investment details

Opta Sportsdata

Opta Sportsdata is a leading European provider of sports data and analysis. Opta uses proprietary technology to collect and analyses statistical data for a range of sports.

Albion backed Opta from February 2008. In total the funds had invested approximately £2.1 million over three rounds of funding. As a result of the sale, funds managed by Albion have generated a return of over three times their investment.

Investment details

Orchard Portman

In 2010 Albion invested £6.5m in Orchard Portman to acquire a nursing home and constructed a 23 bed psychiatric care hospital as an extension to the existing building. The sale of Orchard Portman will result in the creation of one single psychiatric care hospital with a total of 46 beds, renamed Cygnet Hospital Taunton.

Investment details

Orchard Therapeutics

Orchard Therapeutics is a biotechnology company dedicated to bringing transformative gene therapies to patients with serious and life-threatening orphan diseases.

Orchard Therapeutics is a spin-out from the Institute of Child Health (ICH) at UCL, commercialising a gene therapy platform with the potential to cure a range of rare childhood genetic disorders in a single treatment. The company’s programmes use the potential of ex-vivo autologous haematopoietic stem cell gene therapies to restore normal gene function in severe and life-threatening inherited disorders, including immunodeficiencies and a range of neurological disorders, and have demonstrated excellent safety and efficacy in ongoing clinical trials. Orchard’s shareholders include F-Prime Ventures, UCLB and the UCL Technology Fund.

Investment details

OutThink

World's first cybersecurity human risk management platform (SaaS).

Potrtfolio news

Investment details

Oviva

Oviva is a digital health business providing medical nutritional counselling. The company has developed mobile technology solutions that enable its dietitians to provide superior care in a highly efficient way. Oviva is headquartered in Zurich and currently has operations in Germany and the UK.

Investment details

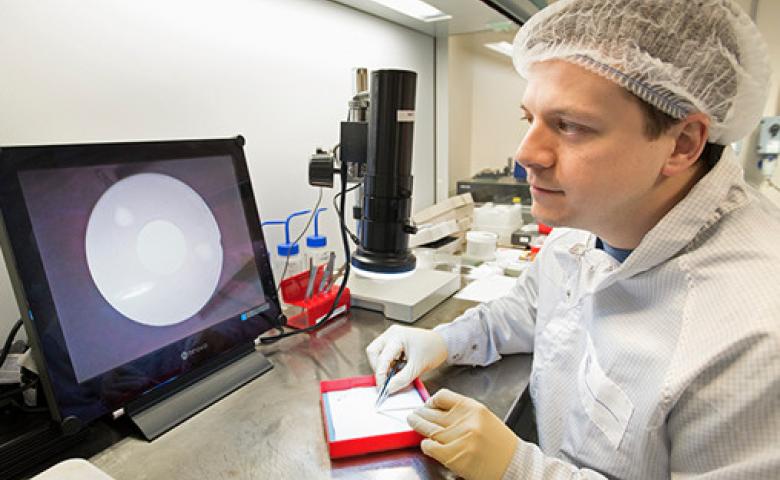

Oxsensis

Oxsensis is an industrial technology company pioneering a new breed of optical instrumentation for precision controls in super harsh environments, with a range of “clean-tech” applications such as power generation applications. Their revolutionary next-generation instrumentation is designed to enable improved engine efficiency for cleaner power. Some of the world’s leading aerospace and power generation companies are closely involved in the development of their range of fibre-optic instrumentation. Established in 2003 and based in Oxfordshire, Oxsensis is a winner of The Carbon Trust Innovation Award and the Institute of Engineering and Technology (IET) Innovation Award.

Potrtfolio news

Investment details

Palm Tree Technology

Palm Tree Technology has developed LiveEnsure™, a cloud-based mobile authentication solution. The business, headquartered in Palo Alto, authenticates users in consumer and B2B environments.

Investment details

Panaseer

Panaseer is the first Continuous Controls Monitoring software platform to give CISOs visibility of all assets, and the confidence that security controls are working effectively. It provides a trusted, unified view across business lines, regions and technology platforms. Deployed by major financial institutions in the US and UK, the Panaseer platform empowers CISOs and security teams to implement and measure effective cybersecurity risk reduction.

Potrtfolio news

Investment details

Pando

Pando is a secure mobile messaging and workflow tool for doctors and care workers. They have established themselves as the leading secure mobile communication platform in the NHS.

Investment details

PeakData

Founded in 2018, PeakData is a rapidly growing technology company that is providing insights and analytics for the world’s top pharmaceutical companies before and after launch. Our team of data scientists, software engineers, and healthcare executives has developed an innovative approach that uses cutting edge big data analytics alongside AI to collate data from across the web and create ranked healthcare professional profiles.

Potrtfolio news

Peppy

Employee healthcare benefits platform.

Investment details

Perchpeek

PerchPeek, the digital relocation platform, that helps companies build mobile, distributed workforces and make overseas relocation easier and less stressful for employees.

Perpetuum

Perpetuum is an industrial technology company that has developed a unique energy harvesting device (micro generator) that generates electricity from vibration.The technology has been used to develop a product which harvest electricity from vibrations in industrial machinery to power wireless sensors on that machinery.

Phasecraft

quantum algorithm

Potrtfolio news

Investment details

Phrasee

Phrasee is a marketing technology platform that uses AI, namely Natural Language Generation and Machine Learning to generate optimised marketing campaigns. Phrasee's AI writes email subject lines, Facebook ads and push notifications that perform better than human-written versions consistently delivering outstanding results for global brands.

Potrtfolio news

Investment details

Premier VCT (Bristol) Limited

Premier VCT (Bristol) owned and operated the Holiday Inn Express near Bristol Templemeads station. The company was successfully sold in September 2002.

Investment details

Premier VCT (Dartford) Limited

Premier VCT (Dartford) built and operated the Holiday Inn Express near Dartford bridge. It was initally built as an 80 bedroom hotel and then extended to 120 bedrooms. The company was successfully sold in November 2000.

Investment details

Premier VCT (Mailbox) Limited

Premier VCT (Mailbox) owned the long leasehold interest in and operated the 90 bedroom Ramada hotel in the Mailbox in Birmingham. It originally opened as a Days Inn before becoming a Days Hotel and was later rebadged as a Ramada hotel. Albion sold Premier VCT (Mailbox) in 2007.

Investment details

Prime Care Holdings

Prime Care operates on the South Coast of England, providing home care services to elderly and disabled clients. The company has won a number of presigeous awards for the quality of care it delivers.

Investment details

Proveca

Proveca focuses on the re-engineering of existing generic medicines to make them appropriate for use by young people. The company is developing and commercialisng medicines for children in the fields of cardiology, neurology and pain management.

Potrtfolio news

Investment details

PSCA International

PSCA International operates an information portal for the public sector in the United Kingdom. The company also publishes various print and online publications related to public service events and public sector recruitment and provides data services. In 2008 AVL achieved a profitable exit to a secondary MBO.

Investment details

PSE

PSE provides world leading predictative modelling software and services to many of the largest companies in the world, including over 60 Fortune 500 companies. PSE brings a step-change in the technology available to develop, design, optimise and innovate.

Potrtfolio news

Investment details

Q Gardens

Exit: We sold Q Gardens for an undisclosed sum in December 2016.

Investment details

Quantexa

Quantexa uses the latest advances in big data analytics and artificial intelligence to help its banking, insurance and government customers detect financial crime.

Potrtfolio news

Investment details

Radnor House School Sevenoaks

Radnor House is a 7 - 18 independent co-educational day school in Twickenham, located in stunning historic buildings on the banks of the River Thames. Formerly the site of Alexander Pope’s mansion where he entertained the literary elite of his day, the buildings have been transformed into a school combining a sense of history with the latest educational provision. The school employs an outstanding team of professionals who have developed a highly successful and innovative approach to education provision. Albion exited Radnor House School in 2017.

Radnor House, Sevenoaks is a co-educational independent school for students aged three to eighteen, located near Sevenoaks, Kent.

In Radnor House, Sevenoaks, Albion and the Radnor House School management team have identified a unique opportunity to expand the Radnor House model by enhancing the school’s culture of academic achievement and first-rate pastoral care, as well as making the necessary investment to provide new facilities and modernise existing ones where necessary. Radnor House, Sevenoaks used to be known as Combe Bank School

Investment details

Radnor House, Sevenoaks

Radnor House, Sevenoaks is a co-educational independent school for students aged three to eighteen, located near Sevenoaks, Kent.

In Radnor House, Sevenoaks, Albion and the Radnor House School management team have identified a unique opportunity to expand the Radnor House model by enhancing the school’s culture of academic achievement and first-rate pastoral care, as well as making the necessary investment to provide new facilities and modernise existing ones where necessary. Radnor House, Sevenoaks used to be known as Combe Bank School

Investment details

Raremark

Raremark, is a real-world data collection platform focused on rare diseases, their technology helps rare disease companies identify, engage and learn from patients, dramatically improving data collection to inform drug development.

Investment details

Red-M

Red-M is an expert wireless consultancy and systems integrator, enabling organisations to fully realise the benefits of wireless systems by providing insight into the opportunities and challenges of current and future wireless technologies and creating mission critical wireless networks. Red-M’s capabilities span all wireless technologies which it applies across a wide range of blue-chip customers and locations including shopping centres, stadia, railway stations and hospitals. Red-M also provide Network Services which offer a suite of last mile and building to building radio based Ethernet connectivity solutions. Red-M was sold to Team Telecom Group in 2012.

Investment details

Regenerco Renewable Energy

Regenerco Renewable Energy Ltd was formed in 2010 in partnership with Industrial Solar. It provides small businesses and councils access to free rooftop solar installations providing them with sustainable source of power, and providing the Albion funds with a longterm, inflation protected source of income

Investment details

Regulatory Renome

Transforms the way regulatory information is consumed

Investment details

RFI Global Services (RFI)

RFI Global Services is a leading provider of testing, approval and consultancy services to the global technology market, including data security, cellular, wireless and smart card technologies. Albion sold the company in June 2010.

Investment details

Runa

Runa is a digital incentives platform whose clients range from global corporates to SMEs.

Investment details

Ryefield Court

Ryefield Court is a purpose-built care home in Hillingdon that offers spacious care facilities within a luxury environment.

Investment details

SBD

Albion exited SBD Automotive delivering a 2.1x return for investors

Potrtfolio news

Investment details

Seldon

Seldon is a cloud agnostic Machine Learning (ML) deployment specialist which works in partnership with industry leaders such as Google, Red Hat, IBM and Amazon Web Services.

Potrtfolio news

Investment details

Shinfield Lodge Care Ltd

Shinfield Lodge is a care home in Reading that offers residents the chance to experience luxury living and exceptional care. Shinfield provides residential, dementia, respite and day care in a stimulating, beautiful environment.

Investment details

Sift Media

Sift is a leading digital publisher operating in three sectors: accounting & finance, small business and enterprise.

Silent Herdsman

Silent Herdsman, a developer of neck-collar monitoring system for dairy cows was acquired by Afimilk Limited, an Israeli based, global provider of dairy farm management solutions in 2016.

Investment details

Solidatus

Data lineage and metadata management solution helps businesses rapidly map and visualise their data landscape.

Investment details

Sparesfinder

Founded in 1998, Sparesfinder provides data solutions to international enterprises with significant inventory management needs, including parts management and data cleansing, across multiple locations and multiple IT systems.

Clients include world leaders in the petrochemical, tobacco and mining industries.

Investment details

Speechmatics

Speechmatics turn voice data into text for analysis, discovery and accessibility

Investment details

Street by Street Solar Programme

Street by Street Solar Programme was formed in 2010 in partnership with Engensa. It provides homeowners access to free rooftop solar installations providing them with sustainable source of power, and provides the Albion funds with a long term, inflation protected source of income

Investment details

Symetrica

Symetrica specializes in the detection and identification of radioisotopes for Security Applications.

Working predominantly with prime contractors and government agencies, Symetrica design, develop, test and deploy detection equipment for use by law enforcement personnel, customs officers, the emergency services, military personnel and first responders.

Investment details

tem.

AI-driven climate tech startup revolutionising how renewable energy is bought and sold.

Potrtfolio news

Investment details

Tender Loving Childcare Ltd

Tender Loving Childcare operates purpose built nurseries predominantly positioned on NHS hospital sites. The company operates an innovative business model enabling it to provide a high quality environment while minimising the cost of development of each nursery. The investment was sold to Learning Care Group in 2008.

Investment details

The Bear Hotel Hungerford

The Bear Hungerford Limited owns and operates the 41 bedroom Bear Hotel in Hungerford. Albion sold The Bear Hungerford in March 2013.

Investment details

The Charnwood Pub Co.

The Charnwood Pub Company owned and operated 10 public houses in central England. All have now been sold.

Investment details

The Crown Hotel Harrogate Limited

The Crown Hotel in the centre of Harrogate is a 115 bedroom hotel with extensive conference and banqueting facilities which has been restored to its former glory. Albion exited the Crown Hotel in August 2017

Investment details

The Evewell

The Evewell is a pioneering women’s health clinic that provides care covering all aspects of a woman’s reproductive and gynaecological health, located on Harley Street.

The centre, focuses on fertility and IVF treatments through a fully integrated suite of women’s health services that differentiates it from other clinics. The clinic is equipped with the latest technologies for screening and treatment, and is set in a discrete and luxurious environment that provides a best-in-class service.

The Evewell is led by medical director Colin Davis, a renowned surgeon in laparoscopic and endoscopic treatments, with a focus on quality of service provision and a commitment to addressing a gap in the market for holistic fertility treatments.

Investment details

The Place Sandwich VCT Limited

The Place Sandwich owned and operated the 37 bedroom Bell Hotel in Sandwich. Following extensive refurbishment and revival of the hotel's trading, the company was sold to Shepherd Neame in September 2011.

Investment details

The Printworks Health Club

The Printworks Health Club & Spa was acquired by SDI Property in 2015.

Investment details

The Stanwell Hotel Limited

The Stanwell Hotel is located near Heathrow Terminal 5 and has been extended and refurbished to create a 52 bedroom boutique hotel.

Investment details

The Weybridge Club Limited

The Weybridge Club is set in 30 acres of Surrey countryside between Weybridge and Walton. Members can indulge in a luxury spa therapy, relax by the swimming pool or work away any stress in our fully equipped gym.

Albion invested in The Weybridge Club in April 2005. Albion sold The Weybridge Club in June 2017.

Investment details

Thebigworld Group

Thebigword provides translation and localisation services worldwide. Using innovative technologies, the company has become one of the fastest growing businesses in its industry.

Investment details

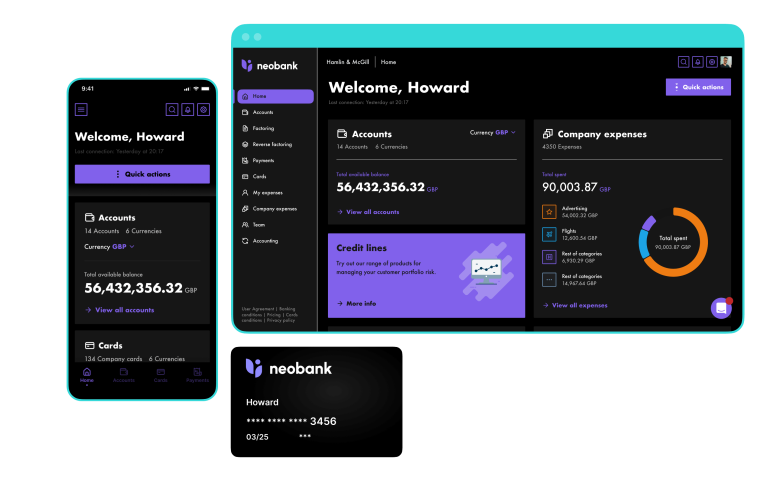

Toqio

SaaS-based global financial orchestration platform

Potrtfolio news

Investment details

Tower Bridge Health & Fitness Club

Tower Bridge Health & Fitness Club was acquired by Third Space in 2014. The sale generated an attractive return for the Albion funds and the founders.

Investment details

TransFICC

TransFICC is a specialist provider of low-latency connectivity and workflow services for Fixed Income and Derivatives Markets.

Investment details

uMed

uMed's software solution automates the processes in running clinical research registries while ensuring regulatory compliance.

Investment details

uMotif

uMotif provides a patient engagement and data capture platform for use in real world and observational research.

Investment details

Uniservity

The company provides learning technology solutions to schools in the UK and Australia. Albion exited its investment in September 2015.

Investment details

Vivacta

Provider of software for ne.ar-patient immunoassay testing applications. Acquired by Novartis.

Investment details

Workshare

Workshare, a leading provider of document collaboration software was acquired by Skydox, backed by Scottish Equity Partners and The Business Growth Fund in 2013.

Investment details

Xceleron

Xceleron has pioneered the use of AMS analysis in pre-clinical and clinical development. AMS is the world's most sensitive analytical instrument and can provide critical human metabolism data at an early stage in the development process. The bulk of the operations are now run out of Maryland, US. Xceleron was sold to Pharmaron in January 2017.

Investment details

Xention

Xention is developing novel therapies for the treatment of atrial fibrillation using its proprietary platform of ion channel drug discovery and development.

Zift Solutions

Zift Solutions offers technology that automates channel marketing, sales and operations processes. It provides the service and strategic insight modern B2B organisations require to simplify channel management and maximise profitability from their entire channel ecosystem. A global business, Zift Solutions is headquartered in Jersey City, USA and has offices in the UK, Australia and Romania.