Page 18 - Spring_2022

P. 18

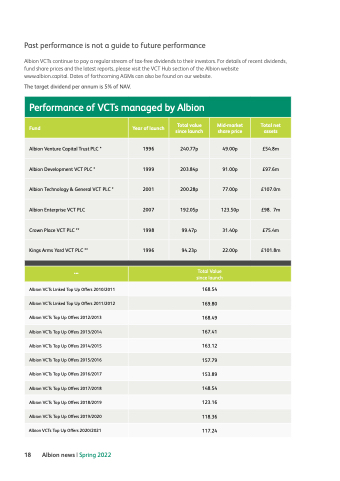

Past performance is not a guide to future performance

Albion VCTs continue to pay a regular stream of tax-free dividends to their investors. For details of recent dividends, fund share prices and the latest reports, please visit the VCT Hub section of the Albion website

www.albion.capital. Dates of forthcoming AGMs can also be found on our website.

The target dividend per annum is 5% of NAV.

Performance of VCTs managed by Albion

Fund

Year of launch

Total value since launch

Mid-market share price

Total net assets

Albion Venture Capital Trust PLC *

1996

240.77p

49.00p

£54.8m

Albion Development VCT PLC *

1999

203.84p

91.00p

£97.6m

Albion Technology & General VCT PLC *

2001

200.28p

77.00p

£107.0m

Albion Enterprise VCT PLC

2007

192.05p

123.50p

£98. 7m

Crown Place VCT PLC **

1998

99.47p

31.40p

£75.4m

Kings Arms Yard VCT PLC **

1996

94.23p

22.00p

£101.8m

***

Total Value since launch

Albion VCTs Linked Top Up Offers 2010/2011

168.54

Albion VCTs Linked Top Up Offers 2011/2012

169.80

Albion VCTs Top Up Offers 2012/2013

168.49

Albion VCTs Top Up Offers 2013/2014

167.41

Albion VCTs Top Up Offers 2014/2015

163.12

Albion VCTs Top Up Offers 2015/2016

157.79

Albion VCTs Top Up Offers 2016/2017

153.89

Albion VCTs Top Up Offers 2017/2018

148.54

Albion VCTs Top Up Offers 2018/2019

123.16

Albion VCTs Top Up Offers 2019/2020

118.36

Albion VCTs Top Up Offers 2020/2021

117.24

18 Albion news | Spring 2022